5 Mobile Gaming Industry Trends in 2021

2020 has been a good year for mobile gaming, and 2021 is expected to be an even better one.

Mobile gaming has caught the eyes of many investors since its growth has expedited in the 2010’s with the spread of smartphone ownership. Fueled by this mobile growth, video gaming revenue surpassed that of the television industry and became the biggest entertainment sector in 2017.

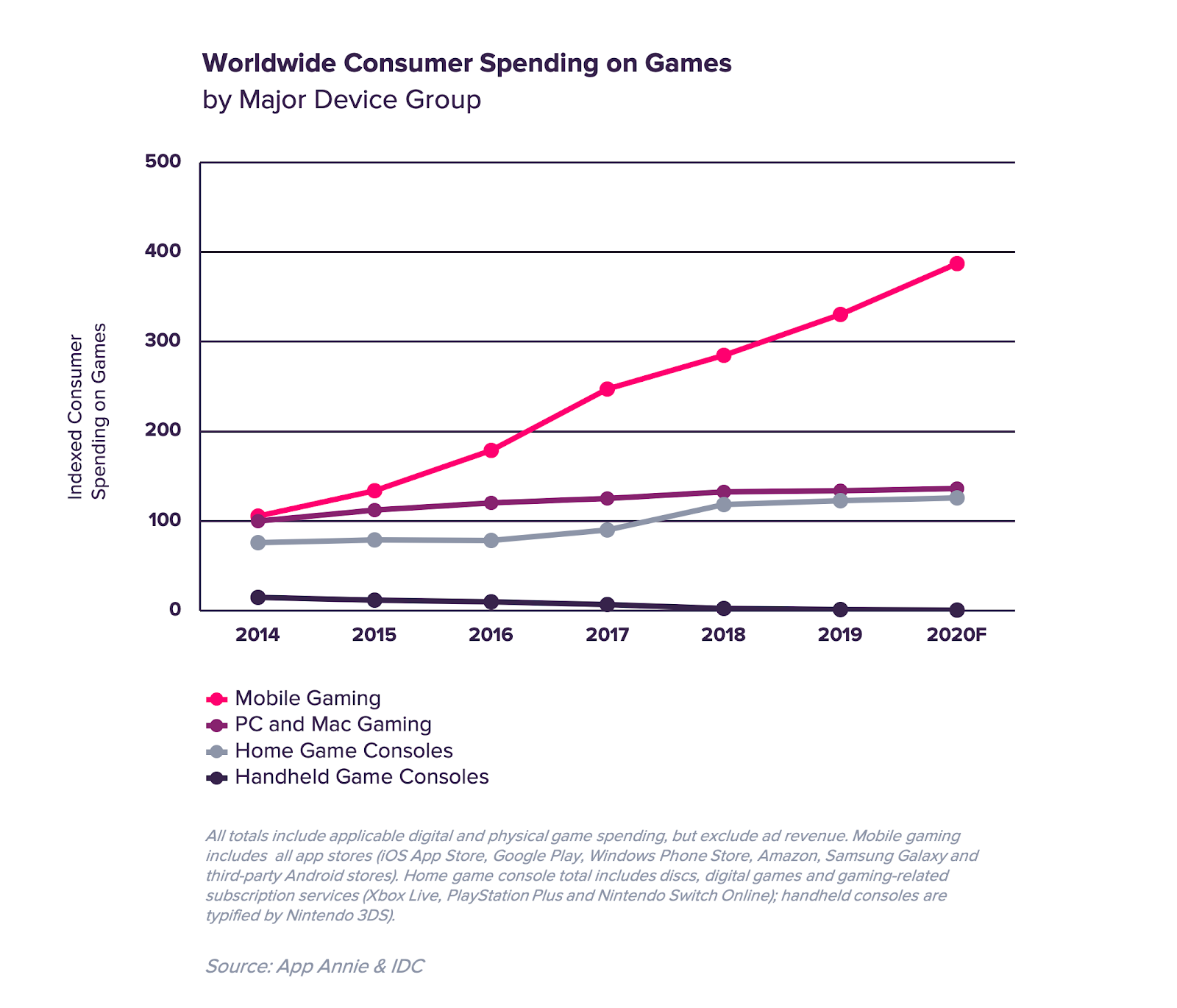

As seen in the graph below by App Annie, mobile gaming is strongly pushing the industry growth, and the dominance is not expected to dwindle in the coming year.

So what kind of changes and developments do we foresee in this leading industry next year? Here is a list of five trends we suggest game developers and investors to watch out for.

Continued market growth fueled by technology

As one could imagine, the growth momentum for the mobile gaming industry is expected to be carried over in 2021. App Annie expects that the consumer spend on global app stores will surpass $120 billion, with a 7-year-CAGR of 23%.

New technologies such as virtual reality or augmented reality are among the latest app trends which are not just limited to gaming. Games incorporating VR headsets or AR graphics give the gamers a different sensation from traditional games. Using face recognition and voice recognition to maneuver a game is another area with great potential that has not yet been fully explored.

The rise of gametech is also expected to drive further growth of the gaming industry, by empowering developers to create captivating games and to monetise and advertise them in a more sophisticated manner. Gametech refers to various programs or tools that help developers enhance the performance of their games, such as game engines, game analytics, and user acquisition services.

Esports

In 2021, esports revenue is expected to reach $1.6 billion.

Live streaming has grown exponentially in the past few years, led by apps like YouTube and Instagram, as well as Twitch in the case of gaming and esports. Spectating professional esports matches or watching amateur players live stream is especially popular among younger gamers. According to a survey conducted by Limelight, gamers aged 18-25 spend 4.12 hours per week watching other people play games online via channels like Twitch or YouTube.

The covid-19 pandemic has also cast a silver lining to the esports industry as Twitch viewership grew from 1.4 million in Q1 2020 to 2.4 in Q2, according to analytics firm Stream Hatchet. As esports have grown its audience immensely in 2019, 2020 is a year to solidify its position as a part of the mainstream sports.

Increased ad engagement

With the increase in mobile traffic during the covid-19 pandemic, mobile ad engagement has also seen a great rise. Mobile ad engagement surged by up to 15% in the spring, and those aged 18 to 24 showed especially higher receptivity to mobile ads.

As mobile ads’ effectiveness rises, advertisers are spending more and more as well. In the first half of 2020, mobile ad placements grew by 70%, and the global mobile ad spend is expected to grow at a 2-year CAGR of 21% to $290 billion in 2021, according to App Annie.

In-game ad inventory has proven to be a great channel to target diverse yet highly engaged audience groups. It is expected that with increased ad engagement, in-game ad spaces will be more sought after and provide good sources of monetisation for developers.

Increased ad monetisation, even for IAP-focused games

According to a survey conducted by Google in May 2020, 34% of gamers who choose to watch in-game ads do so in order to receive boosters and power-ups, while 30% do so to unlock additional lives. As such, a lot of the users who may not be willing to make in-app purchases would still be willing to opt-in ads to experience premium features.

In 2020, the cost of acquiring paying users for mobile games has jumped 24% year-on-year to $43.88, while the cost to acquire a player has dropped by 66% to $1.47 according to Liftoff. As many new players have entered the mobile gaming market recently while staying home, there seems to be an increase in casual users who are not willing to make purchases but would be willing to watch ads. This means that in the coming year, developers should focus on ad monetisation rather than encouraging in-app purchases to target these players.

More opportunities for indie developers

As the user base for mobile games expands, and as gamers develop a taste for a variety of game genres and styles, indie games have become popular these days. Independent developers often offer new and experiential games as they are not controlled by big publishers, which for game developers usually means more room to be creative with their game.

Moreover, Apple has announced to cut the App Store fee to 15%, down from 30%, from 2021 onwards to new developers and developers with less than $1 million annual app revenue; a long-awaited change for developers. This will pose great opportunities for more indie developers to self-publish their games with less financial risks. Utilising this extra income on paid user acquisition, expedited with user acquisition funding could help accelerate indie developers’ growth more than ever.

If you would like to stay ahead of the competition and be prepared to scale up in 2021, get in touch!